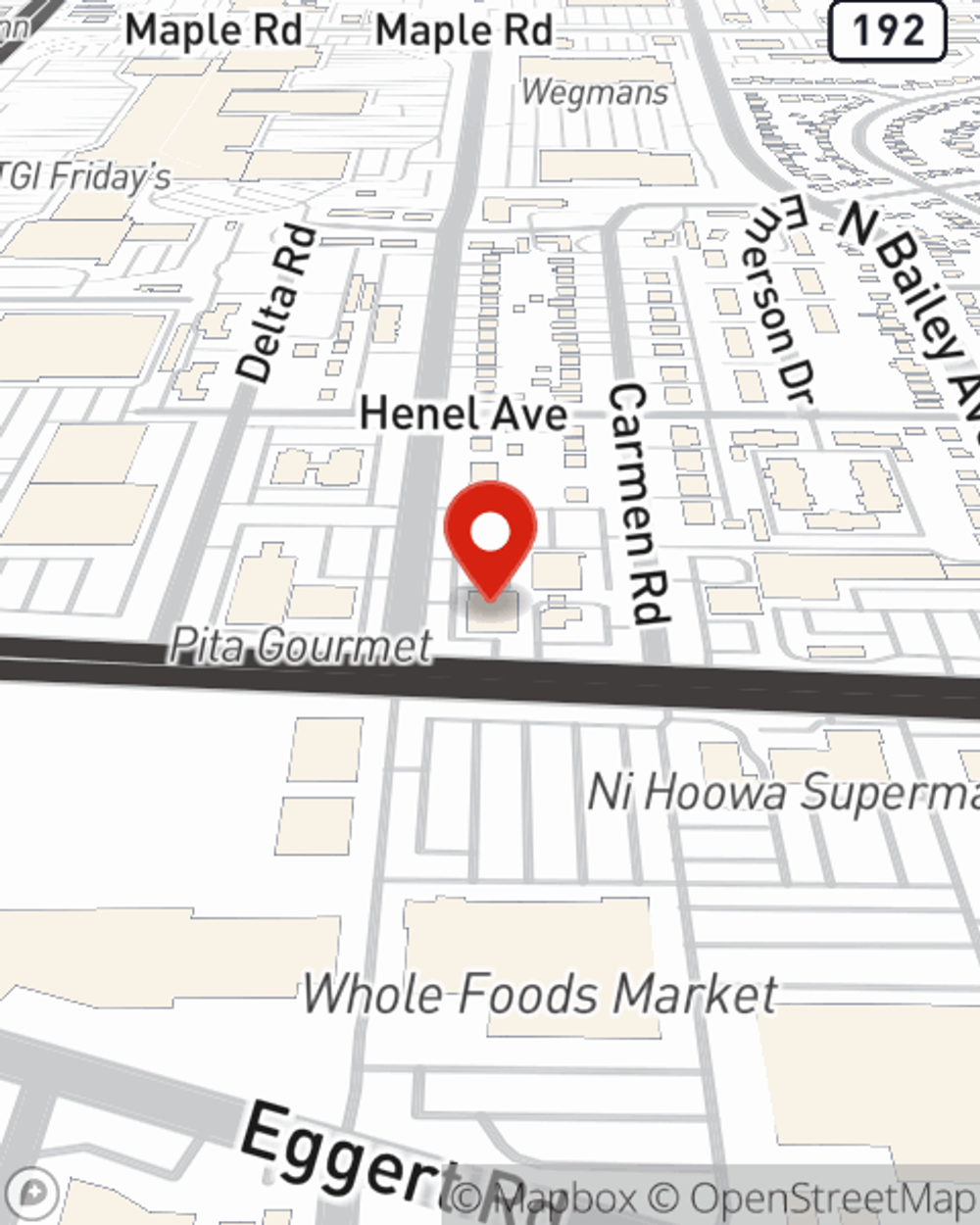

Business Insurance in and around Amherst

Get your Amherst business covered, right here!

Helping insure businesses can be the neighborly thing to do

Help Prepare Your Business For The Unexpected.

Do you own a sporting good store, a tailoring service or a home improvement store? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on making this adventure a success.

Get your Amherst business covered, right here!

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

You are dedicated to your small business like State Farm is dedicated to reliable insurance. That's why it only makes sense to check out their coverage offerings for artisan and service contractors, business owners policies or commercial liability umbrella policies.

Since 1935, State Farm has helped small businesses manage risk. Contact agent Michele Proietti's team to learn about the options specifically available to you!

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Michele Proietti

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.